Guide To Small-business Accounting Software For Mac

. Home. Get tips on running a successful business in our small business guides. Get ideas on running your practice in our accountant and bookkeeper guides.

Xero advisors share their triumphs, failures, and learnings on their journey. Find Xero webinars, training courses and other education content at Xero U.

Find videos on using Xero, case studies, product updates and more on Xero TV. Keep up to date on all things Xero. Clean innovative ideas and insights from people who know business inside out. Get answers fast and ask questions.

For software reviewers to understand Xero's products and features. Challenges for small businesses using a Mac It’s likely that if you’re a Mac fan and user, you’ll have high expectations for the way your accounting software looks and performs. But when we talk to small businesses, it’s clear that while Mac users love their Apple products, they’re not as affectionate about their financial software. So why is this such a common sentiment? Software that is just a lift and shift from PC to Mac doesn’t leverage the power and design that’s at the heart of Apple products. As a Mac user, you probably remember that moment when you first booted up your Mac and thought “Ahh”.

And it’s that emotion that’s often lacking while using accounting software. It’s no coincidence that the instant ease of use and logical user interface of Apple products have won countless awards. So when Mac users are confronted with software that doesn’t apply human logic to the design or functionality, financial tasks become painful. Accounting software on a Mac should ‘just work’. Mac versions are often lacking in features Most financial applications are designed for a PC first and then ported over to a Mac as an afterthought. As a result, Mac users are often left with feature lacking versions and poor customer support which is typically focused on PC usage.

In many companies, customer support don’t fully know about or understand the Mac platform to help with in-depth questions. It’s also common for Mac software versions to also have lots of unnecessary features. This can mean you end up getting a bloated suite of complex and confusing tools instead of what your small business really needs. Make it a priority to go with software that doesn’t tack on features for the sake of it, and gets the balance of simplicity and usability just right. You should have everything you want and need, and no more. Software should be cross-platform compatible If your software isn’t cross-platform friendly, you risk wasting huge chunks of time using workarounds to collaborate with your financial advisors. For example, if you use a Mac and want to share data with your PC-using accountant, you’ll need to export data files to them saved in a Windows format.

Even at this stage, you’ll often run into compatibility issues. In the meantime, while your accountant is looking at your data, you won’t be able to make changes to it because you can’t merge their changes into your existing file. It’s only when they’re finished with the file that you can re-import it.

In many cases, the software won’t work on all browsers either, which makes for a poor user experience. Business apps should integrate with your software Often Mac accounting software has a limited range of business applications or apps that integrate with it.

But if you’re a Mac user, you’ll no doubt be used to having a variety of products that play nicely with your Apple devices. For example, you might already be using, project management software that runs in the cloud, and encourages collaboration online. As well as being easy to use on a Mac, iPad and iPhone, Basecamp also integrates with several other apps. If you’re in the creative industry, may be the way you share files, give feedback or save settings across devices.

Is another handy online tool that lets you collect and find everything that you need, and collaborate with colleagues online. All of this considered, it makes sense to look out for financial software that is also flexible enough to allow a range of apps to integrate with it. As your company grows, this will make it much easier to manage all aspects of running your business. For example, you could integrate invoicing, time tracking or job system apps with your financial software. Online tools like, make time tracking simple for small business – and they’re Mac-friendly.

Harvest is time tracking software that lets you see real-time data to keep projects on time and in budget. Software needs to be simple and frustration-free Apple design their products so that they are super simple to use. The financial software you choose for your Mac should be just as easy.

You should get one consistent, magical experience, whether you’re on a Mac, iPhone, or an iPad. For example, if you’re out and about and need to send an invoice, you should be able to do it on your iPad with minimal effort. It should be as easy as a few taps and you’re done. With one version for all devices and browsers, doing business becomes much more pain-free and fun. Like an Apple product ‘just works’, your online software should too. Accounting software on a Mac: Seven points to consider. Intuitive and beautiful design matters The simple, aesthetically-pleasing form and function of an Apple product is what makes many Mac users loyal for life.

So when it comes to your software, don’t skimp on this all-important aspect. Often small business financial applications are bloated with far too many under-used features that only get in the way. Installation has to be easy Just like how a Mac works straight out of the box, your small business software should be easy to start using.

With cloud software, there are no installations or downloads. You just log in online at any time, from wherever you are. Updates and upgrades are done automatically, and are free. Great customer support is important As a Mac user, you are used to outstanding customer support. So it makes sense to choose software with the same level of excellent service, who won’t cut corners on training staff for Mac usage. No matter how complex your problem is, you should have a qualified person answering your questions.

Look for companies that produce guides, videos, tutorials and forums to help you with day-to-day business tasks. Have all your business data in one place Organising your files on a Mac is as simple as ‘drag and drop’. So consider financial software that works in the same way. When you can drag and drop and attach source files to your invoices, bills, transactions, fixed assets and contacts, your company documents can all live in one place online.

Some software will also allow you to email files straight into your accounting application. Collaborate more with your team A core belief at Apple is that “collaboration is essential for innovation”. Follow their lead, and ensure that your financial application takes collaboration seriously. Look for software that lets you have as many users as you want, at no extra cost. This will help you collaborate with your accountant or bookkeeper and get the advice you need, when you need it.

Your business will be in a much better position to innovate and be successful. Use online business tools that integrate Apple products have a huge range of third-party applications that all work seamlessly together. So don’t restrict your business growth by using software that won’t integrate with other apps. Your small business will benefit and run smarter when you can integrate apps with your accounting software to manage all aspects of it from one place.

For example, if you’re an, you could use use cloud-based applications to stay competitive and enhance your customers’ experience. Stability and security is key Macs are secure and stable, and not as susceptible to the viruses or hacking that some hardware is prone to. In the same way, the best online accounting software heavily protects your sensitive financial data. Companies that store your data in offsite servers ensure that your information is protected with the highest level of security.

All data is encrypted to the same level as your internet banking. Make business fun again As a Mac fan, you’ll have a deep-seated appreciation for software that puts ease of use and beautiful design first. Naturally, this means you’ll gravitate towards software that also reflects those qualities.

So why not choose a product that not only delights you, but makes business and life easier? When you’re having fun, and excited about using your accounting software, you’ll be much more in tune with your financial situation and in a better position to grow. And that’s got to be good for business.

If home is where your heart is, then there’s a pretty good chance that home—or at least your Home Folder—is where you prefer to keep your business’ financial information. While there are plenty of excellent you can use for tracking your business finances, if you’re uncomfortable with the idea of working within a browser and keeping your business’ financial information in the cloud, a traditional Mac application is your best option. I looked at four apps for managing your business invoicing and finances: Cognito Software’s, The Acclivity Group’s, Intuit’s, and Marketcircle’s. The first three are traditional invoicing and accounting applications, while Billings Pro offers compelling features, but also requires additional software to complete the package. Though all of these apps offer excellent tools for managing your business finances, MoneyWorks Gold stands above the rest, for an excellent user interface.

Top choice: MoneyWorks Gold 7 If you’ve been around the Mac accounting game for any length of time you’re likely already aware of the more well-known players, QuickBooks and AccountEdge. The one application that probably hasn’t made it onto your radar—but should have—is Cognito Software’s (; $499). MoneyWorks Gold is a solid, full-featured business accounting application that is networkable, supports multiple users, and works on both Macs and PCs. MoneyWorks offers simple access to all your business data and the options for sharing your data with Mac and PC users on your network. MoneyWorks uses a flowchart-like interface similar to what’s used by both AccountEdge and QuickBooks for Mac.

The application’s interface consists of a sidebar with navigation links to MoneyWorks’ collection of financial tools and a larger main window that displays a flowchart that changes depending on which item you’ve selected in the sidebar. As is the case with both AccountEdge and QuickBooks 2014, the flowchart attempts to create a visual relationship between various business activities.

While this makes all of these applications a bit more interesting visually, in practice I’ve rarely used the flowchart to figure out how the many aspects of a business are related. Most of the tools you’ll use on a regular basis appear in the navigation section entitled Day-to-day.

Here you can create quotes, sales orders, and invoices, reconcile your bank accounts, create and receive purchase order items, and review accounts payable. Each of these same tasks are also available in other areas of the application and selecting other Navigation options provides you with access to a deeper set of tools and features. For example, when you select Items and Inventory you have tools for receiving stock on items you’ve ordered, viewing a journal list of all the stock you have on hand, and building new stock items from items you have in your existing inventory. With multiple users enabled, MoneyWorks makes it easy to manage which users have access to what in your company’s data file. MoneyWorks includes just under 100 reports, including sales tax reports for Canada and VAT reports for the U.K.

Guide To Small Business Accounting Software For Mac Uk

If none of the application's existing reports fit your specific needs, you can create custom reports of your own. Reports are available either from the Reports menu or from the main application window when you’ve selected a specific navigation area. For example, selecting Chart of Accounts from the navigation sidebar provides you with links for a number of account-related reports. Two features make MoneyWorks a standout: Multiuser network capabilities and cross-platform client applications.

(Features also found in Acclivity’s AccountEdge product.) Sharing your MoneyWorks file on the network is as simple as opening the Sharing and Users settings and putting a check in a box to turn on sharing. (A Datacenter version allows access by iOS devices and multicompany hosting) By default the application allows access to anyone on the network, so to limit access you also need to password protect your data file. Once you do so you can add users and limit their access to features.

Unfortunately, there is no group option for managing user access to data, so every user you create needs to have access managed individually. Top contender: AccountEdge Pro Depending on how you look at Acclivity’s (; $399 new, $159 single user upgrade, $249 multiuser upgrade) it is either a little stale or as consistent as it has ever been. The basic idea behind the application’s flowchart interface has been around since it was first released well before Mac operating systems were named after cats. Little has changed about the way the AccountEdge looks in nearly a dozen years, but, in terms of accounting capabilities, it remains a solid application.

Little has changed in the way AccountEdge looks, but you’ll find a number of new features under the covers that should enhance your accounting experience. AccountEdge has long been an application that allowed you to do your business in a networked environment on both Macs and PCs and, like MoneyWorks, gives you control over who has access to specific parts of your company’s financial data. The program still provides excellent tools for securing your data while still providing access to your accounting and inventory data in a multiuser, multiplatform environment. While not much has changed on the front end, AccountEdge has added a few new features for 2014, including the addition of master inventory items that allow you to create dozens of varieties with out having to create distinct inventory items for each variety.

So, for example, you can create a category called Whole Bean Coffee that can then be broken down into more specific varieties such as specific roasts in caffeinated or decaf, all of which makes it much easier to manage your inventory. Acclivity has also rebranded and updated its AccountEdge Web front end, offering features in the cloud, including options for creating invoices and other transactions from a webpage. The rest of the pack Billings Pro 1.6.5 Marketcircle’s (; $0/$5/$10 per month per user plans, or $99 per year per user) is beautifully-designed application that uses a subscription-based service with some Web-based features, but with which you create invoices, estimates, and collect time-billing information using your Mac OS or iOS device. Everything you do is created and managed locally and then synced with using a database that is hosted on Marketcircle’s servers. Billings Pro offers the most beautiful, customizable invoice, estimate, and statement documents you will find in any similar application. I’ve used the Mac and iOS versions of the original Billings application for years and, like many, was disappointed when Marketcircle dropped the standalone application in favor of a client-server subscription model. That said, after about a month of using Billings Pro instead of the standalone application, I found it to be better than the old standalone version.

Billings Pro is not an accounting application, but you can export Billings Pro data directly into QuickBooks for Mac or MoneyWorks 6. (At present, MoneyWorks 7 is not supported, but Marketcircle states that support is forthcoming.) What makes Billings a standout is integrated time billing and what are probably the most beautiful, customizable documents you will ever see in a program of this type. The key here, though, is time billing. While almost every business accounting package you’ll find offers a way to enter time billing information into time sheets, Billings Pro lets you track your time in the field, and create an invoice directly from the collected information. This may sound like a small deal, but it’s integral to the way many people bill for services, and a feature missing from all of the other applications mentioned here. While I do love Billings Pro, it’s not perfect and requires you to discover the “Billings Pro workflow” before you can use it.

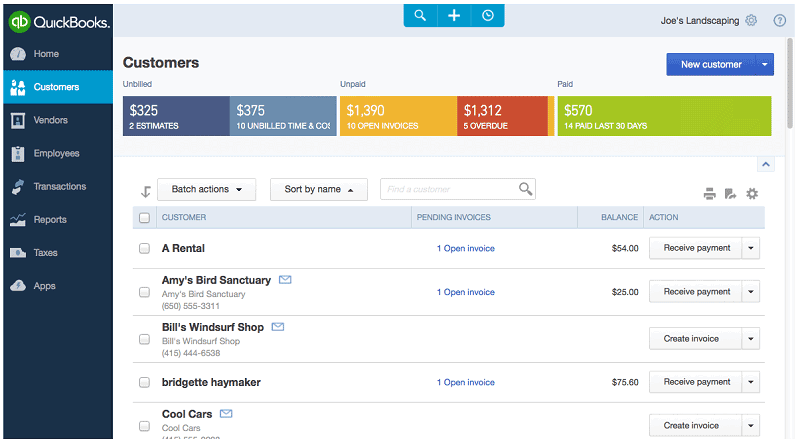

In the Billings Pro world everything you do needs to be part of a project, so no matter what you’re doing, you have to set up a project first and then add Working Slips to those projects and bill based on information collected in the slip. This isn’t a huge problem, but may be an unnecessary step for some businesses. QuickBooks Mac 2014 got a (; $250) last December. Well, no surprise, there haven’t been any changes. While it offers no cross platform capabilities, QuickBooks for Mac 2014 still offers excellent small business accounting tools. While this business accounting application has made it easier to get your data to and back from your accountant, it is still incapable of working in mixed Mac and PC environments.

Sad, but true. But that doesn’t mean that it’s a poor accounting application. QuickBooks for Mac will take good care of your business finances, as long as you understand its limitations. A new user interface gives QuickBooks a look and feel similar to and the new Web interface for. This new look gives you a great overview of your financial status at a glance. While not everything you might want, QuickBooks for Mac 2014 still gives you what you need to take care of business.

Bottom line Color me surprised. While AccountEdge remains an excellent application for managing your business finances, and remains one of my personal favorites, MoneyWorks Gold offers all the accounting features you’ll need, though it is more expensive than AccountEdge. And while it doesn’t offer any true accounting features, Billings Pro is the only invoicing application available that allows you to create invoices from time billing information you collect. For me, that’s a necessary feature missing from all of the other applications. QuickBooks, while good, still lags behind the others because it lacks the cross-platform capabilities necessary for any fully networked cross-platform business environment.

Editor's note: Updated on 4/10/14 to correct MoneyWorks Gold pricing.